Table Of Content

If you don't currently have an active flood policy, click "Continue" to get a quote online. Your home is more than just a building; it's where memories are made and futures are built. With the unique challenges Florida homeowners face, having the right insurance is paramount. Take the first step towards safeguarding your most cherished investment. When you click "Continue" you will be taken to a site owned by , not GEICO. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Compare the best homeowners insurance in Florida

Experts warn that the state insurer may struggle to handle a major weather event.

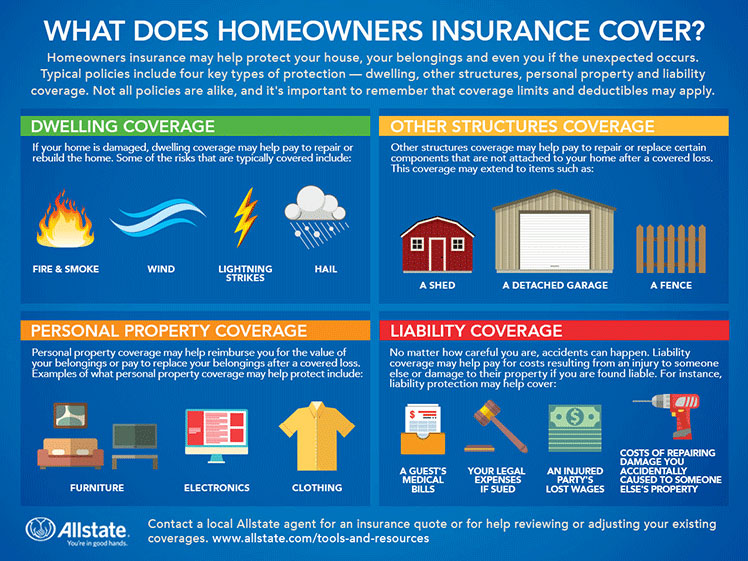

What does homeowners insurance cover in Florida?

Florida insurance company drops thousands of homeowners in SWFL ahead of hurricane season - NBC2 News

Florida insurance company drops thousands of homeowners in SWFL ahead of hurricane season.

Posted: Sat, 27 Apr 2024 13:41:00 GMT [source]

The state Senate’s Banking and Insurance Committee voted favorably on the bill, 8-0, on April 5, but it still has to go through both houses to become law. Tailrow Insurance is owned by HCI Group, which also operates Homeowners Choice and TypTap Insurance. The move comes after Florida officials, including Gov. Ron DeSantis, have raised concerns about the size of the insurer of last resort.

Best homeowners insurance companies of April 2024

Citizens’ membership has skyrocketed to nearly 1.1 million members as home insurance companies have fled the state or gone out of business. Though new flood insurance costs may double or triple in parts of South Florida, current flood insurance policyholders won’t likely see substantial rate increases immediately. Current policies can only increase by as much as 18% annually in most instances. The provision is part of recently enacted Florida property insurance reform measures, which included attempts to reduce the size of the Citizens.

Best homeowners insurance in California April 2024

Our hard-working team of data analysts, insurance experts, insurance agents, editors and writers, has put in thousands of hours of research to create the content found on our site. An endorsement is an addition or adjustment to your insurance coverage, terms or conditions of the policy. It is simply a way for you to add or change the coverages on your policy so you will have the additional coverage you need for your home and personal property. From Jan. 1, 2024 to Jan. 1, 2027, it doesn’t matter if you live in a flood zone or not, you’ll be required to purchase flood insurance if you have a home insurance policy that includes wind coverage through Citizens Insurance. Affordable Florida home insurance companies do exist, as our analysis demonstrates.

Florida homeowners insurance cost hikes: 5 things to know - Naples Daily News

Florida homeowners insurance cost hikes: 5 things to know.

Posted: Tue, 23 Apr 2024 17:29:49 GMT [source]

Check out our article Florida wind mitigation breakdown and find out if this can lower your FL homeowners insurnace quote. Our company earns commission from our insurance partners, allowing us to keep HoneyQuote free. Looking for more information to help you find the best homeowners insurance in Florida? The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

If you learn that your carrier is going out of business or not writing policies in your state anymore, “the first thing you should do is contact your insurance agent. This will be your primary point of contact to formulate a game plan,” recommends Gregg. “The variables can vary from the type of coverage you have to your deductible level to the type of loss – whether it’s a fire, water-related, or act-of-God loss,” explains Kenneth Gregg, CEO of Orion180 in Melbourne, Florida. Homeowners insurance is not required by law in Florida or any other state. However, all mortgage companies require home insurance in the loan agreement.

Average Home Insurance Costs for $200,000 Dwelling Coverage

It is still the responsibility of the insured to evaluate their coverage every year to determine whether the amount on the policy is sufficient. If an insured has concerns about the amount of coverage, they should speak with their agent about completing a new replacement cost estimate for their home. Our analysis of rates determined that the cost of home insurance in Florida is $3,227 per year, based on the average of dwelling coverage limits from $200,000 to $750,000. Mark Frieldander of Triple-I estimates homeowners in Florida are paying much more — an average of $6,000 per year — which is more than triple the average annual premium in the U.S.

Remember that some companies only offer coverage in certain parts of Florida. The amount of coverage you purchase is one of the biggest factors that impacts your home insurance premium. More coverage generally costs more money, but also provides more financial protection. Below are the average Florida homeowners insurance rates by coverage level. Homeowners in every state have to wrestle with home insurance issues, but Florida homeowners especially have to tackle rising costs and some insurers no longer offering coverage in the state. We provide the latest information, average home insurance costs and guidance on what to do if your Florida home insurance company goes out of business or doesn’t renew your policy.

In recent years, more and more homeowners in Florida are running into difficulty when it comes to insuring their homes, which has caused many to turn to Citizens. MoneyGeek scores for homeowners insurance in Florida were calculated using a scaled and weighted average of J.D. Power Property Claims and Customer Satisfaction Scores, actual homeowners insurance quotes and financial stability ratings from A.M. Power scores 60%, affordability 30% and financial stability 10%, adjusting weightings in the sections focused specifically on affordability and service experience.

Review the most commonly asked questions below to get an idea of where you can get started. Citizens’ policies may not be the most affordable, but they are the best for expensive homes, given their high customer satisfaction ratings and financial stability scores. To get a home insurance quote in Florida, begin by reviewing our top-rated Florida insurers and our annual best home insurance companies rankings. Once you've narrowed the list to three to five companies, begin requesting the estimates. Tower Hill charges the most affordable home insurance rates to Florida homeowners, at an average of $2,443 a year. Increasing costs tied to the lawsuits and fraud have caused several local insurance companies to close their doors.

Any insurance policy premium quotes or ranges displayed are non-binding. The final insurance policy premium for any policy is determined by the underwriting insurance company following application. Home insurance is so expensive in Florida because the state is at high risk for severe weather damage due to lightning strikes, hurricanes, tornadoes, wildfires, and more. Since there’s a higher chance of homeowners filing a claim, home insurance companies charge higher rates for this added risk. If that’s the case, you’ll need windstorm insurance — a special type of property insurance that specifically covers your home and belongings from wind or hail damage. Windstorm insurance is sometimes available as an add-on to your homeowners insurance, though it can also be purchased as a separate wind-only policy.

Having trouble finding an affordable rate or getting coverage from one of the best Florida home insurers above? Here, we break down a timeline of Florida's ongoing insurance home crisis and give tips for navigating the complex insurance market as you shop for coverage. Security First Insurance comes with cheap rates that are $1,000 below the state average in Florida. It also stands out thanks to its wealth of discounts — 14 to be exact — that can help you save even more on coverage. Florida homeowners can use Policygenius to compare home insurance quotes from several companies, including Citizens, Universal Property, and Slide Insurance. The homeowners also have a $1,000 deductible, a $500 hail deductible and a 2 percent hurricane deductible (or the next closest deductible amounts that are available) where separate deductibles apply.

No comments:

Post a Comment